VED Change

How to calculate the new RFL changes

As of 2017, the new rules for VED (Vehicle Excise Duty) or 'road tax' will come into effect. This means the road tax bands will have an affect on anyone who leases a car from April 2017 onwards. The tables below provide the current figures (as of 31st March 2017) and the new bands that will follow these.

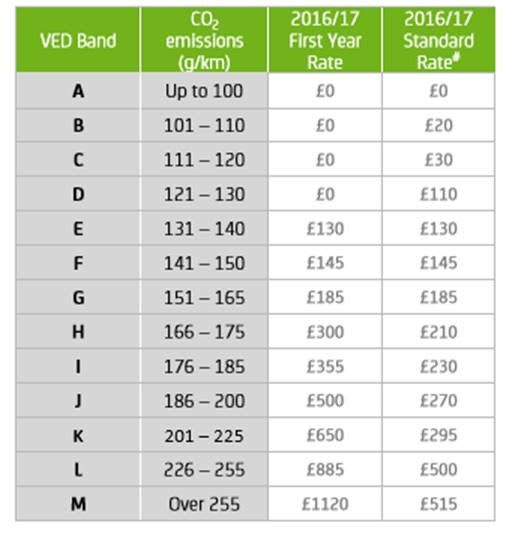

Current Scheme up until 31st March 2017

For example a car with 169 g/km co2 on a 3 year contract will be

- First Year Rate £300

- Second Year RFL £210

- Third Year RFL £210

- TOTAL £720

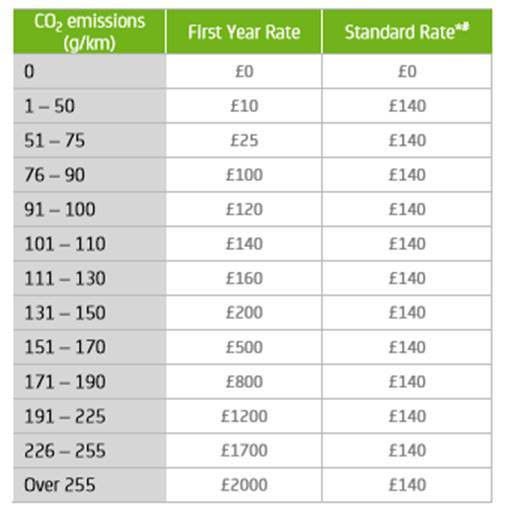

New Scheme from 1st April 2017

The same car with 169 g/km co2 on a 3 year contract will be

- First Year Rate £500

- Second Year RFL £140

- Third Year RFL £140

- TOTAL £780

In Addition

Any car with a list price £40,000 and over will incur an additional £310 on top of the Standard Rate for every year after the first year